Beautiful Business Interruption Worksheet Depreciation Background

Beautiful Business Interruption Worksheet Depreciation

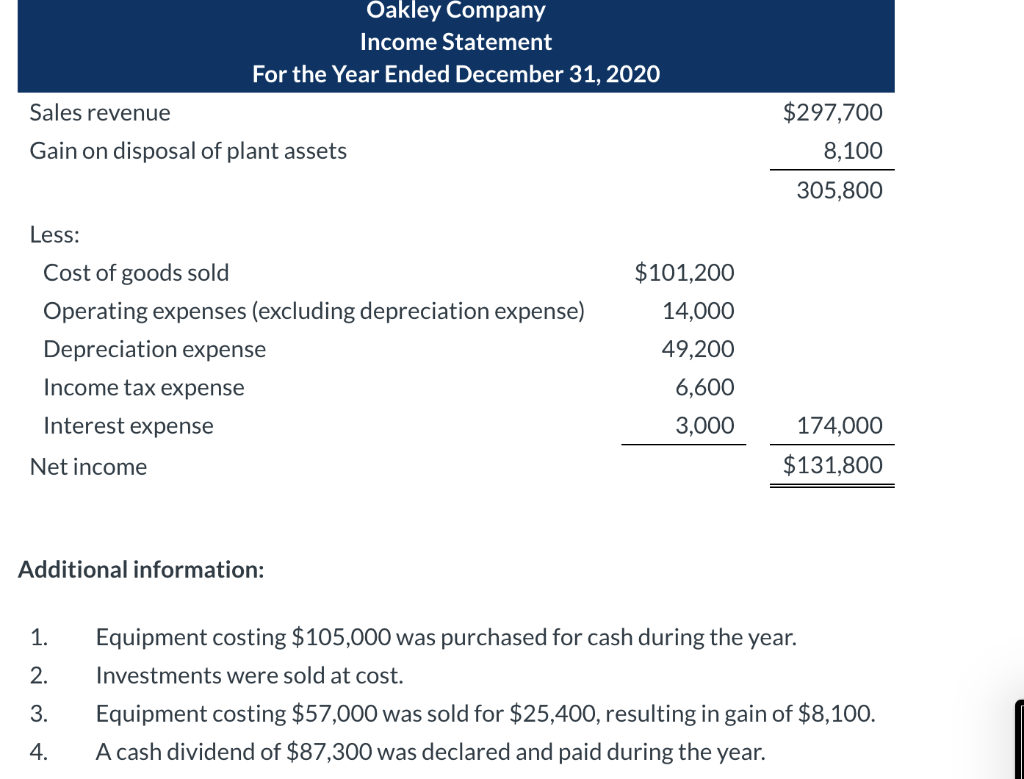

Background. Business interruption insurance, commonly called lost profit insurance is written to protect a firm. Depreciation entails a series of ongoing entries set to claim the cost of a fixed asset.

Want to learn how to depreciate business look no further charles explains code section 167 outlined in the internal revenue code and explains how each of the deductions works.

Gross earnings gross earnings shall be defined as the net sales value of production less the cost of. You may need to keep additional records for accounting and state income tax purposes. Simple depreciation, known in the business world as straight line. Depreciation reflects the decline in value of assets over time.